Now that you're about half way through college, here's one piece of advice you should always remember.

Be your own trader.

Don't follow someone else's trading advice blindly. Just because someone may be doing well with their method, it doesn't mean it will work for you. We all have different market views, thought processes, risk tolerance levels, and market experience.

Have your own personalized trading plan and update it as you learn from the market.

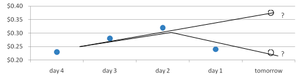

With rock solid discipline, your trading could look like this.

Developing a Trading Plan and sticking to it are the two main ingredients of trading discipline.

But trading discipline isn't enough.

Even solid trading discipline isn't enough.

It has to be rock solid discipline.

We repeat: rock solid. Like Jacob Black's abs.

Plastic solid discipline won't do. Nor will discipline made from straws and sticks.

We don't want to be little piggies. We want to be successful traders!

And having rock solid trading discipline is the most important characteristic of successful traders.

A trading plan defines what is supposed to be done, why, when, and how. It covers your trader personality, personal expectations, risk management rules, and trading system(s).

When followed to, a trading plan will help limit trading mistakes and minimize your losses. After all, "if you fail to plan, then you've already planned to fail."

Showing posts with label Day trading. Show all posts

Showing posts with label Day trading. Show all posts

Saturday, September 24, 2011

Multiple Time Frame Analysis

Image via Wikipedia

Image via WikipediaWhat the heck is multiple time frame analysis?

Multi-time frame ana... WHAT?! Chill out young padawan, it ain't as complicated as it sounds! You're almost done with high school - now's not the time to get senioritis, although you probably got that way back in Grade 12. Ha!

Multiple time frame analysis is simply the process of looking at the same pair and the same price, but on different time frames.

Remember, a pair exists on several time frames - the daily, the hourly, the 15-minute, heck, even the 1-minute!

This means that different traders can have their different opinions on how a pair is trading and both can be completely correct.

Phoebe may see that EUR/USD is on a downtrend on the 4-hour chart. However, Sam trades on the 5-minute chart and sees that the pair just ranging up and down. And they could both be correct!

As you can see, this poses a problem. Trades sometimes get confused when they look at the 4-hour, see that a sell signal, then they hop on the 1-hour and see price slowly moving up.

What are you supposed to do?

Stick with one time frame, take the signal and completely ignore the other time frame?

Flip a coin to decide whether you should buy or sell?

Luckily for you, we here at BabyPips.com aren't about to let you graduate without knowing how to use multiple time frame analysis to your advantage.

First, we'll try to help you determine which time frame you should focus on. Each trader should trade a specific time frame that fits his or her own personality (more on this later).

Secondly, we'll also teach you how to look at different time frames of the same currency pair to help you make better, more educated trading decisions

Fundamental Analysis

Along your travels, you've undoubtedly come across Gulliver, Frodo, and the topic of fundamental analysis.

Wait a minute...

We've already given you a teaser about fundamental analysis during Kindergarten! Now let's get to the nitty-gritty!

What is it exactly and will I need to use it? Well, fundamental analysis is the study of fundamentals! That was easy, wasn't it? Ha! Gotcha!

There's really more to it than that. Soooo much more.

Whenever you hear people mention fundamentals, they're really talking about the economic fundamentals of a currency's host country or economy.

Economic fundamentals cover a vast collection of information - whether in the form of economic, political or environmental reports, data, announcements or events.

Even a credit rating downgrade qualifies as fundamental data and you should see how Pipcrawler turned this news into a winning short EUR/USD trade.

Fundamental analysis is the use and study of these factors to forecast future price movements of currencies.

It is the study of what's going on in the world and around us, economically and financially speaking, and it tends to focus on how macroeconomic elements (such as the growth of the economy, inflation, unemployment) affect whatever we're trading.

Fundamental Data and Its Many Forms

In particular, fundamental analysis provides insight into how price action "should" or may react to a certain economic event.

Fundamental data takes shape in many different forms.

It can appear as a report released by the Fed on U.S. existing home sales. It can also exist in the possibility that the European Central Bank will change its monetary policy.

The release of this data to the public often changes the economic landscape (or better yet, the economic mindset), creating a reaction from investors and speculators.

There are even instances when no specific report has been released, but the anticipation of such a report happening is another example of fundamentals.

Speculations of interest rate hikes can be "priced in" hours or even days before the actual interest rate statement.

In fact, currency pairs have been known to sometimes move 100 pips just moments before major economic news, making for a profitable time to trade for the brave.

That's why many traders are often on their toes prior to certain economic releases and you should be too!

Generally, economic indicators make up a large portion of data used in fundamental analysis. Like a fire alarm sounding when it detects smoke or feels heat, economic indicators provide some insight into how well a country's economy is doing.

While it's important to know the numerical value of an indicator, equally as important is the market's anticipation and prediction of that value.

Understanding the resulting impact of the actual figure in relation to the forecasted figure is the most important part. These factors all need consideration when deciding to trade.

Phew!

Don't worry. It's simpler than it sounds and you won't need to know rocket science to figure it all out.

I suggest you visit Pip Diddy's daily economic roundup every day so that you can stay in the loop with the upcoming economic releases.

Wait a minute...

We've already given you a teaser about fundamental analysis during Kindergarten! Now let's get to the nitty-gritty!

What is it exactly and will I need to use it? Well, fundamental analysis is the study of fundamentals! That was easy, wasn't it? Ha! Gotcha!

There's really more to it than that. Soooo much more.

Whenever you hear people mention fundamentals, they're really talking about the economic fundamentals of a currency's host country or economy.

Economic fundamentals cover a vast collection of information - whether in the form of economic, political or environmental reports, data, announcements or events.

Even a credit rating downgrade qualifies as fundamental data and you should see how Pipcrawler turned this news into a winning short EUR/USD trade.

Fundamental analysis is the use and study of these factors to forecast future price movements of currencies.

It is the study of what's going on in the world and around us, economically and financially speaking, and it tends to focus on how macroeconomic elements (such as the growth of the economy, inflation, unemployment) affect whatever we're trading.

Fundamental Data and Its Many Forms

In particular, fundamental analysis provides insight into how price action "should" or may react to a certain economic event.

Fundamental data takes shape in many different forms.

It can appear as a report released by the Fed on U.S. existing home sales. It can also exist in the possibility that the European Central Bank will change its monetary policy.

The release of this data to the public often changes the economic landscape (or better yet, the economic mindset), creating a reaction from investors and speculators.

There are even instances when no specific report has been released, but the anticipation of such a report happening is another example of fundamentals.

Speculations of interest rate hikes can be "priced in" hours or even days before the actual interest rate statement.

In fact, currency pairs have been known to sometimes move 100 pips just moments before major economic news, making for a profitable time to trade for the brave.

That's why many traders are often on their toes prior to certain economic releases and you should be too!

Generally, economic indicators make up a large portion of data used in fundamental analysis. Like a fire alarm sounding when it detects smoke or feels heat, economic indicators provide some insight into how well a country's economy is doing.

While it's important to know the numerical value of an indicator, equally as important is the market's anticipation and prediction of that value.

Understanding the resulting impact of the actual figure in relation to the forecasted figure is the most important part. These factors all need consideration when deciding to trade.

Phew!

Don't worry. It's simpler than it sounds and you won't need to know rocket science to figure it all out.

I suggest you visit Pip Diddy's daily economic roundup every day so that you can stay in the loop with the upcoming economic releases.

Labels:

2002 Nobel Peace Prize,

Alfred Peet,

Alicia Sacramone,

Animal rights,

Business,

Day trading,

European Central Bank,

Federal Reserve System,

Fundamental analysis,

Investing,

Technical analysis,

United States

Market Environment

When two people go to war, the foolish man always rushes blindly into battle without a plan, much like a starving man at his favorite buffet spot.

The wise man, on the other hand, will always get a situation report first to know the surrounding conditions that could affect how the battle plays out.

Like in warfare, we must also get a situation report on the market we are trading. This means we need to know what kind of market environment we are actually in. Some traders cry saying that their system sucks.

Sometimes the system does in fact, suck. Other times, the system is potentially profitable, but it is being utilized in the wrong environment.

Seasoned traders try to figure out the appropriate strategy for the current market environment they are trading in.

Is it time to bust out those Fibs and look for retracements? Or are ranges holding?

Just as the coach comes up with different plays for particular situations or opponents, you should also be able to decide which strategy to use depending on market environment.

By knowing what market environment we are trading in, we can choose a trend-based strategy in a trending market or a range-bound strategy in a ranging market.

Are you worried about not getting to use your beastly range-bound strategy? How about your Bring-Home-Da-Bacon trend-based system?

Have no fear!

The forex market provides many trending and ranging opportunities across different time frames wherein these strategies can be implemented.

By knowing which strategies are appropriate, you will find it easier to figure out which indicators to pull out from your toolbox.

For instance, Fibs and trend lines are useful in trending markets while pivot points, support and resistance levels are helpful when the market is ranging.

Before spotting those opportunities, you have to be able to determine the market environment. The state of the market can be classified into three

The wise man, on the other hand, will always get a situation report first to know the surrounding conditions that could affect how the battle plays out.

Like in warfare, we must also get a situation report on the market we are trading. This means we need to know what kind of market environment we are actually in. Some traders cry saying that their system sucks.

Sometimes the system does in fact, suck. Other times, the system is potentially profitable, but it is being utilized in the wrong environment.

Seasoned traders try to figure out the appropriate strategy for the current market environment they are trading in.

Is it time to bust out those Fibs and look for retracements? Or are ranges holding?

Just as the coach comes up with different plays for particular situations or opponents, you should also be able to decide which strategy to use depending on market environment.

By knowing what market environment we are trading in, we can choose a trend-based strategy in a trending market or a range-bound strategy in a ranging market.

Are you worried about not getting to use your beastly range-bound strategy? How about your Bring-Home-Da-Bacon trend-based system?

Have no fear!

The forex market provides many trending and ranging opportunities across different time frames wherein these strategies can be implemented.

By knowing which strategies are appropriate, you will find it easier to figure out which indicators to pull out from your toolbox.

For instance, Fibs and trend lines are useful in trending markets while pivot points, support and resistance levels are helpful when the market is ranging.

Before spotting those opportunities, you have to be able to determine the market environment. The state of the market can be classified into three

Labels:

2002 Nobel Peace Prize,

Alfred Peet,

Alicia Sacramone,

Animal rights,

Business,

Day trading,

Foreign exchange market,

Investing,

Pivot point,

Support and resistance,

Trade,

Trend line (technical analysis)

Trading Divergences

What if there was a low risk way to sell near the top or buy near the bottom of a trend?

What if you were already in a long position and you could know ahead of time the perfect place to exit instead of watching your unrealized gains, a.k.a your potential Aston Martin down payment, vanish before your eyes because your trade reverses direction?

What if you believe a currency pair will continue to fall but would like to short at a better price or a less risky entry?

Well guess what? There is a way! It's called divergence trading.

In a nutshell, divergence can be seen by comparing price action and the movement of an indicator. It doesn't really matter what indicator you use. You can use RSI, MACD, the stochastic, CCI, etc.

The great thing about divergences is that you can use them as a leading indicator, and after some practice it's not too difficult to spot.

When traded properly, you can be consistently profitable with divergences. The best thing about divergences is that you're usually buying near the bottom or selling near the top. This makes the risk on your trades are very small relative to your potential reward.

Cha-ching!

Higher Highs and Lower Lows

Just think "higher highs" and "lower lows".

Price and momentum normally move hand in hand like Hansel and Gretel, Batman and Robin, Serena and Venus Williams, salt and pepper...You get the point.

If price is making higher highs, the oscillator should also be making higher highs. If price is making lower lows, the oscillator should also be making lower lows.

If they are NOT, that means price and the oscillator are diverging from each other. And that's why it's called "divergence."

What if you were already in a long position and you could know ahead of time the perfect place to exit instead of watching your unrealized gains, a.k.a your potential Aston Martin down payment, vanish before your eyes because your trade reverses direction?

What if you believe a currency pair will continue to fall but would like to short at a better price or a less risky entry?

Well guess what? There is a way! It's called divergence trading.

In a nutshell, divergence can be seen by comparing price action and the movement of an indicator. It doesn't really matter what indicator you use. You can use RSI, MACD, the stochastic, CCI, etc.

The great thing about divergences is that you can use them as a leading indicator, and after some practice it's not too difficult to spot.

When traded properly, you can be consistently profitable with divergences. The best thing about divergences is that you're usually buying near the bottom or selling near the top. This makes the risk on your trades are very small relative to your potential reward.

Cha-ching!

Higher Highs and Lower Lows

Just think "higher highs" and "lower lows".

Price and momentum normally move hand in hand like Hansel and Gretel, Batman and Robin, Serena and Venus Williams, salt and pepper...You get the point.

If price is making higher highs, the oscillator should also be making higher highs. If price is making lower lows, the oscillator should also be making lower lows.

If they are NOT, that means price and the oscillator are diverging from each other. And that's why it's called "divergence."

Forex Pivot Points

Image via Wikipedia

Image via WikipediaAre you all excited? It's your last year in junior high before you head off to high school!

Professional traders and market makers use pivot points to identify potential support and resistance levels. Simply put, a pivot point and its support/resistance levels are areas at which the direction of price movement can possibly change.

The reason why pivot points are so enticing?

It's because they are OBJECTIVE.

Unlike some of the other indicators that we've taught you about already, there's no discretion involved.

In many ways, pivot points are very similar to Fibonacci levels. Because so many people are looking at those levels, they almost become self-fulfilling.

The major difference between the two is that with Fibonacci, there is still some subjectivity involved in picking Swing Highs and Swing Lows. With pivot points, traders typically use the same method for calculating them.

Many traders keep an eye on these levels and you should too.

Pivot points are especially useful to short-term traders who are looking to take advantage of small price movements. Just like normal support and resistance levels, traders can choose to trade the bounce or the break of these levels.

Range-bound traders use pivot points to identify reversal points. They see pivot points as areas where they can place their buy or sell orders.

Breakout traders use pivot points to recognize key levels that need to be broken for a move to be classified as a real deal breakout.

Here is an example of pivot points plotted on a 1-hour EUR/USD chart:

As you can see here, horizontal support and resistance levels are placed on your chart. And look - they're marked out nicely for you! How convenient is that?!

Bollinger Bands

Image via Wikipedia

Image via Wikipediaongratulations on making it to the 5th grade! Each time you make it to the next grade you continue to add more and more tools to your trader's toolbox.

"What's a trader's toolbox?" you ask.

Simple!

Let's compare trading to building a house. You wouldn't use a hammer on a screw, right? Nor would you use a buzz saw to drive in nails. There's a proper tool for each situation.

Just like in trading, some trading tools and indicators are best used in particular environments or situations. So, the more tools you have, the better you can adapt to the ever changing market environment.

Or if you want to focus on a few specific trading environments or tools, that's cool too. It's good to have a specialist when installing your electricity or plumbing in a house, just like it's cool to be a Bollinger band or Moving Average expert.

There are a million different ways to grab some pips!

For this lesson, as you learn about these indicators, think of each as a new tool that you can add to that toolbox of yours.

You might not necessarily use all of these tools, but it's always nice to have plenty of options, right? You might even find one that you understand and comfortable enough to master on its own. Now, enough about tools already!

Let's get started!

Bollinger Bands

Bollinger bands are used to measure a market's volatility.

Basically, this little tool tells us whether the market is quiet or whether the market is LOUD! When the market is quiet, the bands contract and when the market is LOUD, the bands expand.

Notice on the chart below that when price is quiet, the bands are close together. When price moves up, the bands spread apart.

That's all there is to it. Yes, we could go on and bore you by going into the history of the Bollinger band, how it is calculated, the mathematical formulas behind it, and so on and so forth, but we really didn't feel like typing it all out.

In all honesty, you don't need to know any of that junk. We think it's more important that we show you some ways you can apply the Bollinger bands to your trading.

Note: If you really want to learn about the calculations of a Bollinger band, then you can go to www.bollingerbands.com.

The Bollinger Bounce

One thing you should know about Bollinger bands is that price tends to return to the middle of the bands. That is the whole idea behind the Bollinger bounce. By looking at the chart below, can you tell us where the price might go next?

If you said down, then you are correct! As you can see, the price settled back down towards the middle area of the bands.

What you just saw was a classic Bollinger bounce. The reason these bounces occur is because Bollinger bands act like dynamic support and resistance levels.

The longer the time frame you are in, the stronger these bands tend to be. Many traders have developed systems that thrive on these bounces and this strategy is best used when the market is ranging and there is no clear trend.

Now let's look at a way to use Bollinger bands when the market does trend.

Silky Smooth Moving Averages

Image via Wikipedia

Image via WikipediaA moving average is simply a way to smooth out price action over time. By "moving average", we mean that you are taking the average closing price of a currency pair for the last 'X' number of periods. On a chart, it would look like this:

Like every indicator, a moving average indicator is used to help us forecast future prices. By looking at the slope of the moving average, you can better determine the potential direction of market prices.

As we said, moving averages smooth out price action.

There are different types of moving averages and each of them has their own level of "smoothness".

Generally, the smoother the moving average, the slower it is to react to the price movement.

The choppier the moving average, the quicker it is to react to the price movement. To make a moving average smoother, you should get the average closing prices over a longer time period.

Labels:

2002 Nobel Peace Prize,

Alfred Peet,

Alicia Sacramone,

Animal rights,

Business,

Currency pair,

Day trading,

Moving and Relocating,

Moving average,

Moving Services,

Transportation and Logistics,

United States

What is a Japanese Candlestick?

What is a Japanese Candlestick?

While we briefly covered candlestick charting analysis in the previous lesson, we'll now dig in a little and discuss them more in detail. Let's do a quick review first.

What is Candlestick Trading?

Back in the day when Godzilla was still a cute little lizard, the Japanese created their own old school version of technical analysis to trade rice. That's right, rice.

A westerner by the name of Steve Nison "discovered" this secret technique called "Japanese candlesticks", learning it from a fellow Japanese broker. Steve researched, studied, lived, breathed, ate candlesticks, and began to write about it. Slowly, this secret technique grew in popularity in the 90s. To make a long story short, without Steve Nison, candlestick charts might have remained a buried secret. Steve Nison is Mr. Candlestick.

Okay, so what the heck are forex candlesticks?

The best way to explain is by using a picture:

Candlesticks can be used for any time frame, whether it be one day, one hour, 30-minutes - whatever you want! Candlesticks are used to describe the price action during the given time frame.

Candlesticks are formed using the open, high, low, and close of the chosen time period.

If the close is above the open, then a hollow candlestick (usually displayed as white) is drawn.

If the close is below the open, then a filled candlestick (usually displayed as black) is drawn.

The hollow or filled section of the candlestick is called the "real body" or body.

The thin lines poking above and below the body display the high/low range and are called shadows.

The top of the upper shadow is the "high".

The bottom of the lower shadow is the "low".

Read more: http://www.babypips.com/school/what-is-a-japanese-candlestick.html#ixzz1Ys4Pib00

While we briefly covered candlestick charting analysis in the previous lesson, we'll now dig in a little and discuss them more in detail. Let's do a quick review first.

What is Candlestick Trading?

Back in the day when Godzilla was still a cute little lizard, the Japanese created their own old school version of technical analysis to trade rice. That's right, rice.

A westerner by the name of Steve Nison "discovered" this secret technique called "Japanese candlesticks", learning it from a fellow Japanese broker. Steve researched, studied, lived, breathed, ate candlesticks, and began to write about it. Slowly, this secret technique grew in popularity in the 90s. To make a long story short, without Steve Nison, candlestick charts might have remained a buried secret. Steve Nison is Mr. Candlestick.

Okay, so what the heck are forex candlesticks?

The best way to explain is by using a picture:

Candlesticks can be used for any time frame, whether it be one day, one hour, 30-minutes - whatever you want! Candlesticks are used to describe the price action during the given time frame.

Candlesticks are formed using the open, high, low, and close of the chosen time period.

If the close is above the open, then a hollow candlestick (usually displayed as white) is drawn.

If the close is below the open, then a filled candlestick (usually displayed as black) is drawn.

The hollow or filled section of the candlestick is called the "real body" or body.

The thin lines poking above and below the body display the high/low range and are called shadows.

The top of the upper shadow is the "high".

The bottom of the lower shadow is the "low".

Read more: http://www.babypips.com/school/what-is-a-japanese-candlestick.html#ixzz1Ys4Pib00

Labels:

2002 Nobel Peace Prize,

Alfred Peet,

Alicia Sacramone,

Animal rights,

Business,

Candlestick,

Candlestick chart,

Day trading,

Godzilla,

Investing,

Research and Analysis,

Technical analysis

Support and Resistance

Support and resistance is one of the most widely used concepts in trading. Strangely enough, everyone seems to have their own idea on how you should measure support and resistance.

Let's take a look at the basics first.

Look at the diagram above. As you can see, this zigzag pattern is making its way up (bull market). When the market moves up and then pulls back, the highest point reached before it pulled back is now resistance.

As the market continues up again, the lowest point reached before it started back is now support. In this way resistance and support are continually formed as the market oscillates over time. The reverse is true for the downtrend.

Plotting Support and Resistance

One thing to remember is that support and resistance levels are not exact numbers.

Often times you will see a support or resistance level that appears broken, but soon after find out that the market was just testing it. With candlestick charts, these "tests" of support and resistance are usually represented by the candlestick shadows.

Notice how the shadows of the candles tested the 1.4700 support level. At those times it seemed like the market was "breaking" support. In hindsight we can see that the market was merely testing that level.

So how do we truly know if support and resistance was broken?

There is no definite answer to this question. Some argue that a support or resistance level is broken if the market can actually close past that level. However, you will find that this is not always the case.

Let's take our same example from above and see what happened when the price actually closed past the 1.4700 support level.

In this case, price had closed below the 1.4700 support level but ended up rising back up above it.

If you had believed that this was a real breakout and sold this pair, you would've been seriously hurtin'!

Looking at the chart now, you can visually see and come to the conclusion that the support was not actually broken; it is still very much intact and now even stronger.

To help you filter out these false breakouts, you should think of support and resistance more of as "zones" rather than concrete numbers.

One way to help you find these zones is to plot support and resistance on a line chart rather than a candlestick chart. The reason is that line charts only show you the closing price while candlesticks add the extreme highs and lows to the picture.

These highs and lows can be misleading because often times they are just the "knee-jerk" reactions of the market. It's like when someone is doing something really strange, but when asked about it, he or she simply replies, "Sorry, it's just a reflex."

When plotting support and resistance, you don't want the reflexes of the market. You only want to plot its intentional movements.

Looking at the line chart, you want to plot your support and resistance lines around areas where you can see the price forming several peaks or valleys.

Other interesting tidbits about support and resistance:

When the price passes through resistance, that resistance could potentially become support.

The more often price tests a level of resistance or support without breaking it, the stronger the area of resistance or support is.

When a support or resistance level breaks, the strength of the follow-through move depends on how strongly the broken support or resistance had been holding.

With a little practice, you'll be able to spot potential support and resistance areas easily. In the next lesson, we'll teach you how to trade diagonal support and resistance lines, otherwise known as trend lines.

Let's take a look at the basics first.

Look at the diagram above. As you can see, this zigzag pattern is making its way up (bull market). When the market moves up and then pulls back, the highest point reached before it pulled back is now resistance.

As the market continues up again, the lowest point reached before it started back is now support. In this way resistance and support are continually formed as the market oscillates over time. The reverse is true for the downtrend.

Plotting Support and Resistance

One thing to remember is that support and resistance levels are not exact numbers.

Often times you will see a support or resistance level that appears broken, but soon after find out that the market was just testing it. With candlestick charts, these "tests" of support and resistance are usually represented by the candlestick shadows.

Notice how the shadows of the candles tested the 1.4700 support level. At those times it seemed like the market was "breaking" support. In hindsight we can see that the market was merely testing that level.

So how do we truly know if support and resistance was broken?

There is no definite answer to this question. Some argue that a support or resistance level is broken if the market can actually close past that level. However, you will find that this is not always the case.

Let's take our same example from above and see what happened when the price actually closed past the 1.4700 support level.

In this case, price had closed below the 1.4700 support level but ended up rising back up above it.

If you had believed that this was a real breakout and sold this pair, you would've been seriously hurtin'!

Looking at the chart now, you can visually see and come to the conclusion that the support was not actually broken; it is still very much intact and now even stronger.

To help you filter out these false breakouts, you should think of support and resistance more of as "zones" rather than concrete numbers.

One way to help you find these zones is to plot support and resistance on a line chart rather than a candlestick chart. The reason is that line charts only show you the closing price while candlesticks add the extreme highs and lows to the picture.

These highs and lows can be misleading because often times they are just the "knee-jerk" reactions of the market. It's like when someone is doing something really strange, but when asked about it, he or she simply replies, "Sorry, it's just a reflex."

When plotting support and resistance, you don't want the reflexes of the market. You only want to plot its intentional movements.

Looking at the line chart, you want to plot your support and resistance lines around areas where you can see the price forming several peaks or valleys.

Other interesting tidbits about support and resistance:

When the price passes through resistance, that resistance could potentially become support.

The more often price tests a level of resistance or support without breaking it, the stronger the area of resistance or support is.

When a support or resistance level breaks, the strength of the follow-through move depends on how strongly the broken support or resistance had been holding.

With a little practice, you'll be able to spot potential support and resistance areas easily. In the next lesson, we'll teach you how to trade diagonal support and resistance lines, otherwise known as trend lines.

Labels:

2002 Nobel Peace Prize,

Alfred Peet,

Alicia Sacramone,

Animal rights,

Candlestick chart,

Day trading,

Market trend,

Pivot point,

Price,

Support and resistance,

Trade,

Trend line (technical analysis)

Subscribe to:

Posts (Atom)